german tax calculator munich

Foreign tax paid may be credited against German tax that relates to the foreign income or may be deducted as a business. 1881 2030.

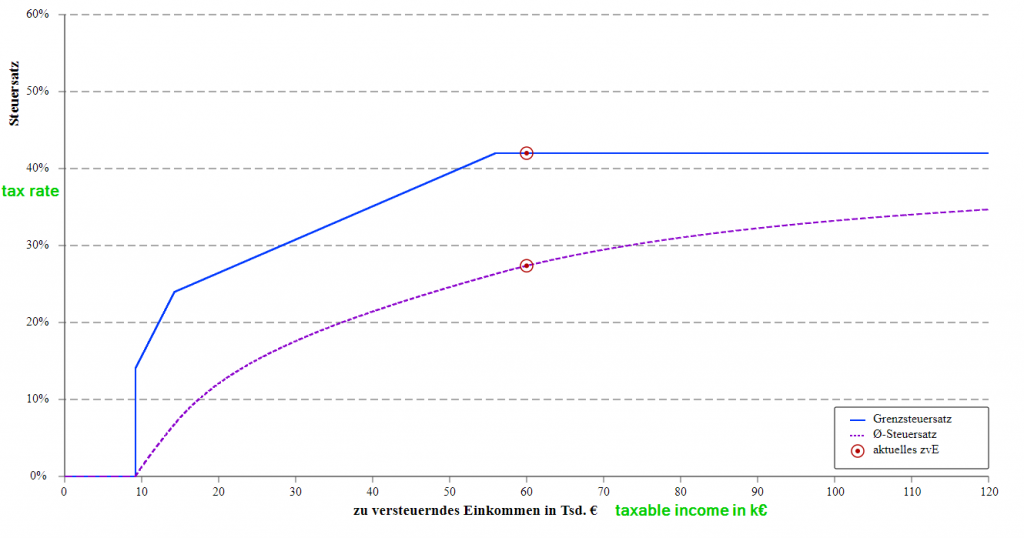

It is a progressive tax ranging from 14 to 42.

. A minimum base salary for Software Developers DevOps QA and other tech professionals in Germany starts at 40000 per year. The basic principal is that income is divided between couples to calculate income tax liability. Germany has one of the lowest minimum spending requirements at 25 EUR.

As a working student you can earn a variable hourly wage between the minimum wage currently 935 Euro February 2020 and 20 Euro. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions. Use our income tax calculator to calculate the tax burden resulting from your taxable income.

Married couples can double that sum. Income Tax calculations and expense factoring for 202223 with historical pay figures on average earnings in Germany for each market sector and location. You can enter the gross wage as an annual or monthly figure.

To the income tax. This sum rises in 2014 to 8354 EUR. Online Calculators for German Taxes.

The so-called rich tax Reichensteuer of 45. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income.

For a final view on German. 6000 EUR 7000 EUR. Try our instant tax calculator to see how much you have to pay as corporate tax dividend tax and Value Added Tax in Germany as well as detect the existence of any double taxation treaties signed with your country of residence.

If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. The SteuerGo Gross Net Calculator lets you determine your net income. Also known as Gross Income.

As of 1 January 2021 the application of the solidarity surcharge tax has been substantially reduced. 18014 a savings of 1715 per year. Salary calculations include gross annual income employment expenses and all insurances and pension factors.

Overall tax for the couple when paying tax separately. Heres Teleports overview of personal corporate and other taxation topics in Munich Germany. Find tech jobs in Germany.

This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. Choose Income Tax Calculator. 2022 2021 and earlier.

Youll then get a breakdown of your total tax liability and take-home pay. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. Our tax calculators are designed to make it easy for you to understand how much you pay and how your money is divided up.

The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. The surcharge is imposed as a percentage on all individual income taxes. More than 7000 EUR.

Unmarried divorced widowed without children. 22572 24355. To calculate the German income tax you owe on your wages you can use the SteuerGo tax calculator.

From a higher income onwards small deductions are made. You can calculate your take home pay based of your annual income PAYE NI and tax for 202223. The more advanced the studies the higher the wage.

Personal tax allowance and deductions in Germany. German Wage Tax Calculator Expat Tax. The tax class affects the rate of income tax solidarity surcharge and church tax.

In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis. Salary Before Tax your total earnings before any taxes have been deducted. Effective personal income tax rate.

After this sum every euro you earn will be taxed with a higher percentage. As you may imagine not every citizen is in the same tax bracket. Note 1 on 2022 German Income Tax Tables.

Just do your tax return with SteuerGo. Singles can earn 8130 EUR per year tax free. The maximum tax rate in Germany is 42 per cent.

As you can see above the tax allowance is double for a married person. There are 6 tax brackets Steuerklassen in Germany. Income more than 58597 euros gets taxed with the highest income tax rate of 42.

Owes annual German income tax of 2701. ICalculator German Income Tax Salary Calculator is updated for the 202223 tax year. To improve the economic situation and infrastructure for certain regions in need the German government has been levying a 55 solidarity surcharge tax.

Unmarried lone parent divorced or widowed with children. Geometrically progressive rates start at 14 and rise to 42. Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc.

Income tax calculator Germany. Tax Calculator in Germany. Married sole wage earner dual wage earner whose spouse has the tax class V married.

Annual income 25000 40000 80000 125000 200000. If you live in Europe but hold long-term visa to some non-EU country you are eligible for VAT refund in Germany. Germany has relatively low refund rate for small purchases at or below 10.

There are six tax classes in Germany. If you only have income as self employed from a trade or from a rental property you will get a more accurate. Your respective tax office will assign you a tax bracket.

The German Tax Calculator is updated for the 202223 tax year. Easily calculate various taxes payable in Germany. It starts with 14 when you earn 8130 EUR plus 100 EUR.

The German Annual Income Tax Calculator for the 2022. The tax bracket Steuerklassen you end up in is dependent on your marital status. For example an employer can calculate an employees income tax Lohnsteuer by means of the tax brackets.

Joint couples tax using Steuerklasse 3 and 5. However how much a company pays also depends on the industry. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can.

Personal taxation in Munich. Please note that this application is only a simplistic tool.

German Income Tax Calculator Expat Tax

German Payroll Example For 55000 55k Income Ta

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

German Tax System Taxes In Germany

1 Speaker Name Andre Marius Le Prince Company Wlp Gmbh Hamburg Germany Wira Ag Munich Stuttgart Dusseldorf Nurnberg Hamburg Germany Phone Ppt Download

Salary Calculator Germany 2022 User Guide Examples Gsf

How The Basic German Income Tax Calculation Works Finance Toytown Germany

Salary Calculator Germany Income Tax Calculator 2022

German Vat Calculator Vatcalculator Eu

Faq German Tax System Steuerkanzlei Pfleger

Calculate Your Taxes In Germany Immigrant Spirit

German Income Tax Calculator Expat Tax

I Want To Learn About German Tax Calculator And Also Is There Any Mandatory Tax Deduction Over And Above What Is Shown In The Calculator Quora

German Income Tax Calculator Expat Tax

Salary Calculator Germany Income Tax Calculator 2022

Salary Calculator Germany 2022 User Guide Examples Gsf

Salary Calculator Germany 2022 User Guide Examples Gsf

German Wage Tax Calculator Expat Tax

Income Tax Einkommenssteuer Ww Kn Steuerberater Fur Den Mittelstand Ww Kn